r&d tax credit calculator hmrc

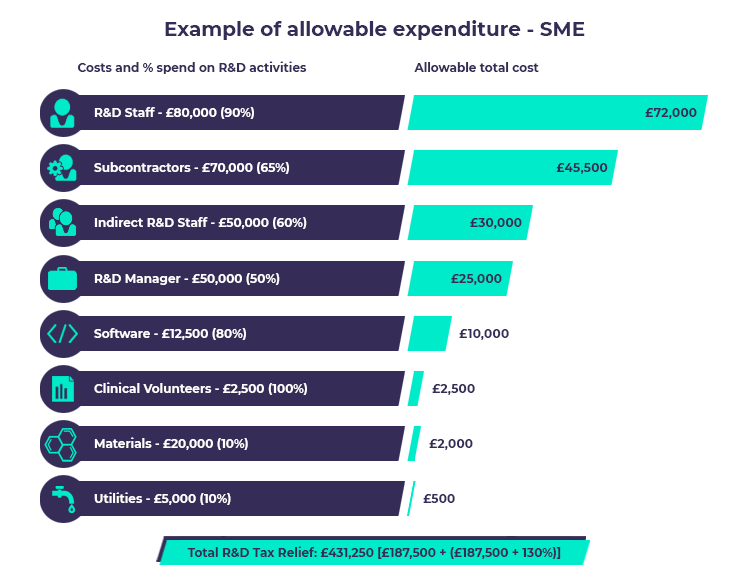

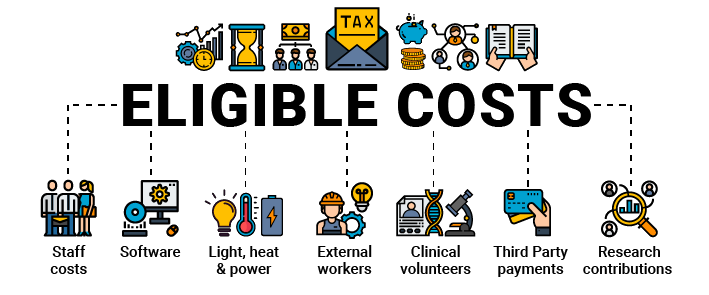

SMEs can claim up to 33p for every 1 spent on qualifying RD activities. Select either an SME or Large company.

R D Tax Credits Explained In 2022 What Are R D Tax Credits Who Is Eligible

The net cash benefit after tax is 11.

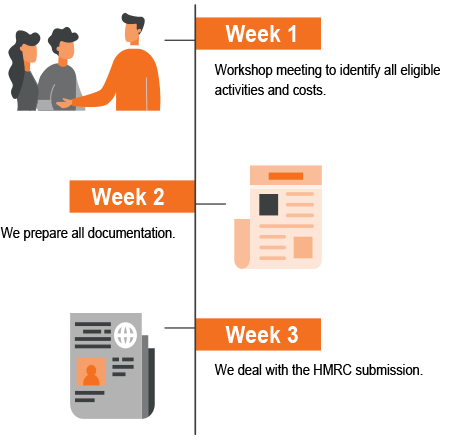

. Estimate how much tax credit including Working Tax Credit and Child Tax Credit you could get every 4 weeks during this tax year 6 April 2021 to 5 April 2022. When they add this 130 uplift to the default 100 they get the enhanced expenditure amount of 230. Our talented team of business and strategy experts can help you with the process.

What is your estimated spend on RD per year. On this page you can calculate the value of your Research Development tax credits claim. If you spend money creating or improving products or services.

The average RD tax credit. This has led to general delays across the service. Guidance on this can be found on our Which RD scheme is right for my company page.

On 17 May 2022 HMRC announced they were temporarily suspending payments of RD claims. This equates to just over 45 of the total 475 billion RD expenditure used to claim tax credits in 2019-20. We estimate you could receive up to.

Free online RD tax credit calculator for UK based startups. Tax credits calculator - GOVUK. Look below at some of the sectors this applies to and get an understanding of how for a few hours of your time you could earn thousands back from HMRC.

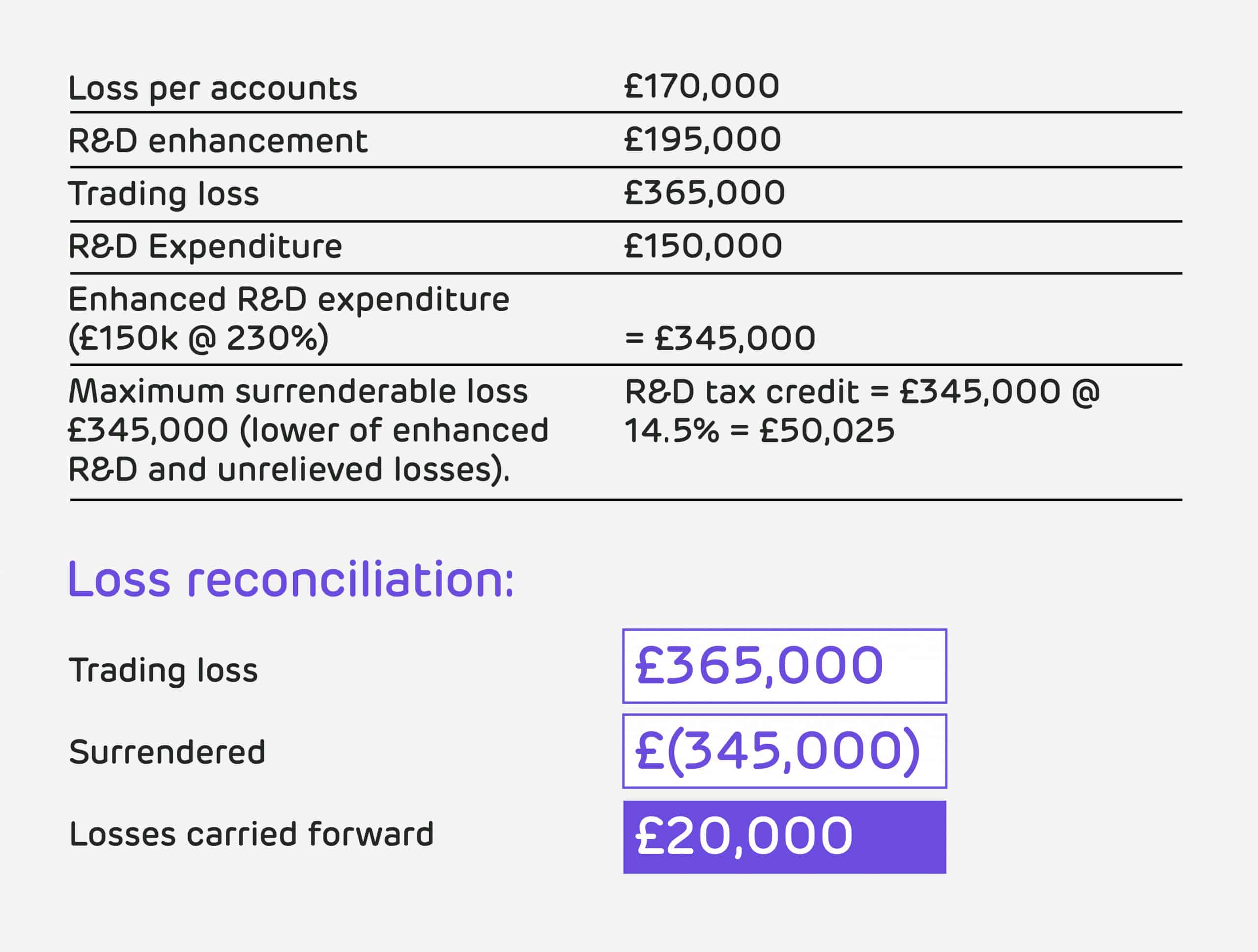

They multiply their eligible RD expenditure of 100000 by 230 to get 230000. According to the latest research and development RD Tax Credits Statistics Report 2018-2019 the average SME. RD Tax Credits Calculator.

Just follow the simple steps below. Profitable and loss making large companies equaly can benefit both potentially obtaining a RD Credit of 97 of their RD spend. As a tax credit.

HMRC tax credits are worth up to 33 of your research and development spend. So the proposed reforms would have a major financial impact on. The credit is calculated at 13 of your companys qualifying RD expenditure this rate applies to expenditure incurred on or after 1 April 2020 and is taxable as trading income.

RDEC claims are paid as a taxable credit which equates to 13 of your eligible RD costs. Get your HMRC RD tax credit claim for your company with the help of our RD tax credit calculator. If the company spent 100000.

The calculator has been specifically developed using historic claim. Show how this example is calculated. The tax benefit can be utilised to reduce your corporation tax bill.

Our RD Tax Credit Calculator answers those questions and gives you an instant estimate of the benefit available to you.

What Is R D Tax Credit How To Calculate And Claim It In 2022

How To Be Proactive With R D Tax Credits Accountants Guide

R D Tax Credits The Essential Guide 2020

R D Tax Credits Calculation Examples G2 Innovation

How Much R D Tax Credit Can You Claim The Uk Average Is 57 000

The R D Tax Credit Explained Youtube

Time To Ditch The Online R D Tax Credit Calculator

Rdec Scheme R D Expenditure Credit Explained

R D Tax Credits Does Your Business Qualify For R D Tax Credits

R D Tax Credit Calculator Cooper Parry

Square Finance Squarefinanceuk Twitter

How To Avoid R D Tax Claim Enquiries Innovation Plus

The Importance Of Using An R D Tax Credit Software

R D Tax Credits Explained The Full Guide Do You Qualify Cooden Tax Consulting